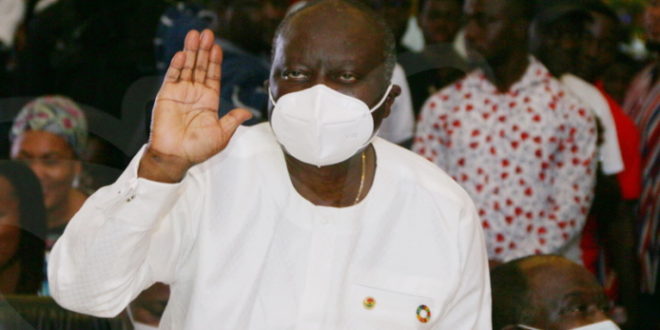

Finance Minister Ken Ofori-Atta has written to the President of the Ghana Insurers Association, informing the group that its industry cannot be exempted from the debt exchange programme as it had earlier requested.

GIA made the request in December 2022 with the reason that 40 per cent of their total assets for the third quarter of last year was invested in Government of Ghana securities.

The group’s president, Mr Seth Kobla Akwasi, told journalists at a press conference on Friday, 9 December 2022: “According to data from NIC, insurance companies invested over GH¢1.5 billion in deposits with licensed banks and money market mutual funds.” “Considering the fact that these banks and fund management companies have also invested in the government of Ghana securities, the debt exchange will further compound the investment base of the insurance industry, since 40% of our investments are directly exposed to the government of Ghana securities an additional 10% exposure from the licensed banks and fund managers will further worsen our situation”, he said.

He added: “In uncertain times like this, entities must protect their assets through insurance, which is a key risk management tool. Anything short of an exemption will have far-reaching consequences for the insurance industry and the important role they play in protecting the assets and liabilities of this country. This will also discourage the citizenry from taking up life and annuity policies”.

“In the absence of the foregoing, the insurance and reinsurance companies will be happy to cede all our claims to the financial stabilisation fund.”

Prior to the GIA, other unions and groups had all kicked against the government’s debt exchange programme.

The Ghana Securities Industry Association (GSIA), for instance, said it cannot accept the programme announced by Finance Minister Ken Ofori-Atta in the 2023 budget. In a statement issued on Wednesday, 7 December 2022, GSIA said: “We, at the GSIA understand the difficult crossroads at which our nation currently finds itself and the difficult choices that need to be made to set us on the path to debt sustainability. However, we are unable to accept the bond exchange program announced by the Minister of Finance in its present form”.

“It is our intention to engage the MoF on our concerns and reservations. We, therefore, urge the investing public to continue to have confidence in us as we pursue this process. In this vein, we entreat clients of our member firms to allow us to engage and then communicate the outcomes to enable them take the best decision on their investments.”

Responding to the GIA’s request, Mr Ofori-Atta said: “Based on your letter and the feedback from you and other industry associations, the government, working with its advisors, has made significant enhancements to the terms of the exchange instruments to address key concerns raised about accrued interest and zero coupons for 2023”.

“The government has also improved the commercial terms of the exchange instruments; which details were announced on 24 December 2022”.

“In this regard, the government encourages a positive response from the industry to enable us to complete the exercise in the interest of the broader economy”, the minister’s letter said, adding that in an earlier meeting with the GIA, “you made it very clear, the peculiar nature of your industry and therefore the forbearance required; an exemption, however, is not an option”.

Recently, Mr Ofori-Atta said Treasury Bills have been exempted from the government’s debt restructuring programme.

Also, individual bondholders will not experience a haircut. The government recently had a staff-level agreement with the International Monetary Fund for a $3-billion credit facility programme, thus, necessitating the debt restructuring exercise. “Under the programme, domestic bondholders will be asked to exchange their instruments for new ones”, Mr Ofori-Atta announced Sunday evening (4 December 2022), adding: “Existing domestic bonds as of 1st December 2022 will be exchanged for a set of four new bonds maturing in 2027, 2029, 2032 and 2037”.

Also, “the annual coupon on all of these new bonds will be set at 0% in 2023, 5% in 2024 and 10% from 2025 until maturity. Coupon payments will be semi-annual”.

Read Mr Ofori-Atta’s full address below:

Good Evening Ghanaians,

In the Budget Statement presented to Parliament on November 24th, I announced that government will undertake a debt operation programme.

The broad contours of the Debt Sustainability Analysis has been concluded and I am here this evening to provide some details on Ghana’s Domestic Debt Exchange which will be launched tomorrow.

External debt restructuring parameters will be presented in due course.

Under the Programme, domestic bondholders will be asked to exchange their instruments for new ones.

Existing domestic bonds as of 1st December 2022 will be exchanged for a set of four new bonds maturing in 2027, 2029, 2032 and 2037.

The annual coupon on all of these new bonds will be set at 0% in 2023, 5% in 2024 and 10% from 2025 until maturity.

Coupon payments will be semi-annual.

Our commitment to Ghanaians and the investor community, in line with negotiations with the IMF, is to restore macroeconomic stability in the shortest possible time and enable investors to realize the benefits of this Debt Exchange.

The Government of Ghana has been working hard to minimise the impact of the domestic debt exchange on investors holding government bonds, particularly small investors, individuals, and other vulnerable groups.

In line with this:

Treasury Bills are completely exempted and all holders will be paid the full value of their investments on maturity. There will be NO haircut on the principal of bonds. Individual holders of bonds will not be affected.

The government recognises that our financial institutions hold a substantial proportion of these bonds.

As such, the potential impact of this exchange on the financial sector has been assessed by their respective regulators.

Working together, these regulators have put in place appropriate measures and safeguards to minimise the potential impact on the financial sector and to ensure that financial stability is preserved.

Specifically:

The Bank of Ghana, the Securities & Exchange Commission, the National Insurance Commission, and the National Pensions Regulatory Authority will ensure that the impact of the debt operation on your financial institution is minimized, using all regulatory tools available to them.

A Financial Stability Fund (FSF) is being established by Government with the help of development partners to provide liquidity support to banks, pension funds, insurance companies, fund managers, and collective investment schemes to ensure that they are able to meet their obligations to their clients as they fall due.

These are difficult times and we count on the support of all Ghanaians and the investor community to make the exercise successful.

We are confident that these measures will contribute to restoring macroeconomic stability.

With your understanding and support and that of the entire investor community, we shall overcome our current difficulties, and with the help of God, put our economy back on the path of renewed and robust growth.

As 1st Samuel 30:19 says, nothing was missing, small or great.

I say to you, nothing will be lost, nothing will be missing, and nothing will be broken.

We will, together, recover all.

Thank you and God bless our homeland Ghana.

Thanks for reading from MyGhanaMedia.com as a news publishing website from Ghana.

Source: MyGhanaMedia.com

Are You Suffering From Weak Erection, Low Libido, Premature Ejaculation Or Infections? – Get M-Plus No

Maccun Plus (MPlus) is for men and women as a natural aphrodisiac with no side effects

Just contact the number below for M PLUS HONEY.

MYGHANAMEDIA.COM Best Source Of Latest News

MYGHANAMEDIA.COM Best Source Of Latest News