The Institute of Climate and Environmental Governance (ICEG) has expressed concerns about the lack of commitment by the government to invest revenue that will be accrued from the Emission Levy.

The Ghana Revenue Authority (GRA) announced that the Emissions Levy Act, 2023 (Act 1112), which imposes a levy on carbon dioxide equivalent emissions on internal combustion engine vehicles, will begin today.

Photo credit: Media General

ICEG has therefore suggested to the government to set up an Emission Fund to ensure a proper accountability mechanism that ensures judicious allocation of funds generated.

In a statement issued by ICEG, it advised the government to ensure that proceeds accrued from the Emission Levy are not deposited into the Consolidated Fund.

“Despite the progressive nature of the Levy, ICEG is concerned about the apparent lack of commitment by the Government beyond the imposition of the Levy, to investing the expected revenue on financing green infrastructure.”

“Proceeds accrued should not be deposited into the Consolidated Fund. The government should consider setting up an Emission Fund to ensure a proper accountability mechanism that ensures judicious allocation of funds generated. Call on the Government to slowly implement the Levy and put up the necessary institutional infrastructure for effective implementation and use of revenue.”

ICEG also called on the government to slowly implement the Levy and put up the necessary institutional infrastructure for effective implementation and use of revenue.

ICEG acknowledged the economic impact on motor vehicle owners, calling on the government to intensify public awareness to inform citizens of the environmental benefits of reducing emissions.

“The government should consider intensifying public awareness to inform citizens of the environmental benefits of reducing emissions,” ICEG said in its statement signed by Kwesi Yamoah Abaidoo, Policy Lead, Climate Finance and Energy Transition.

The Emissions Levy is in line with the government’s efforts aimed at tackling greenhouse gas emissions to promote the use of eco-friendly technology and green energy.

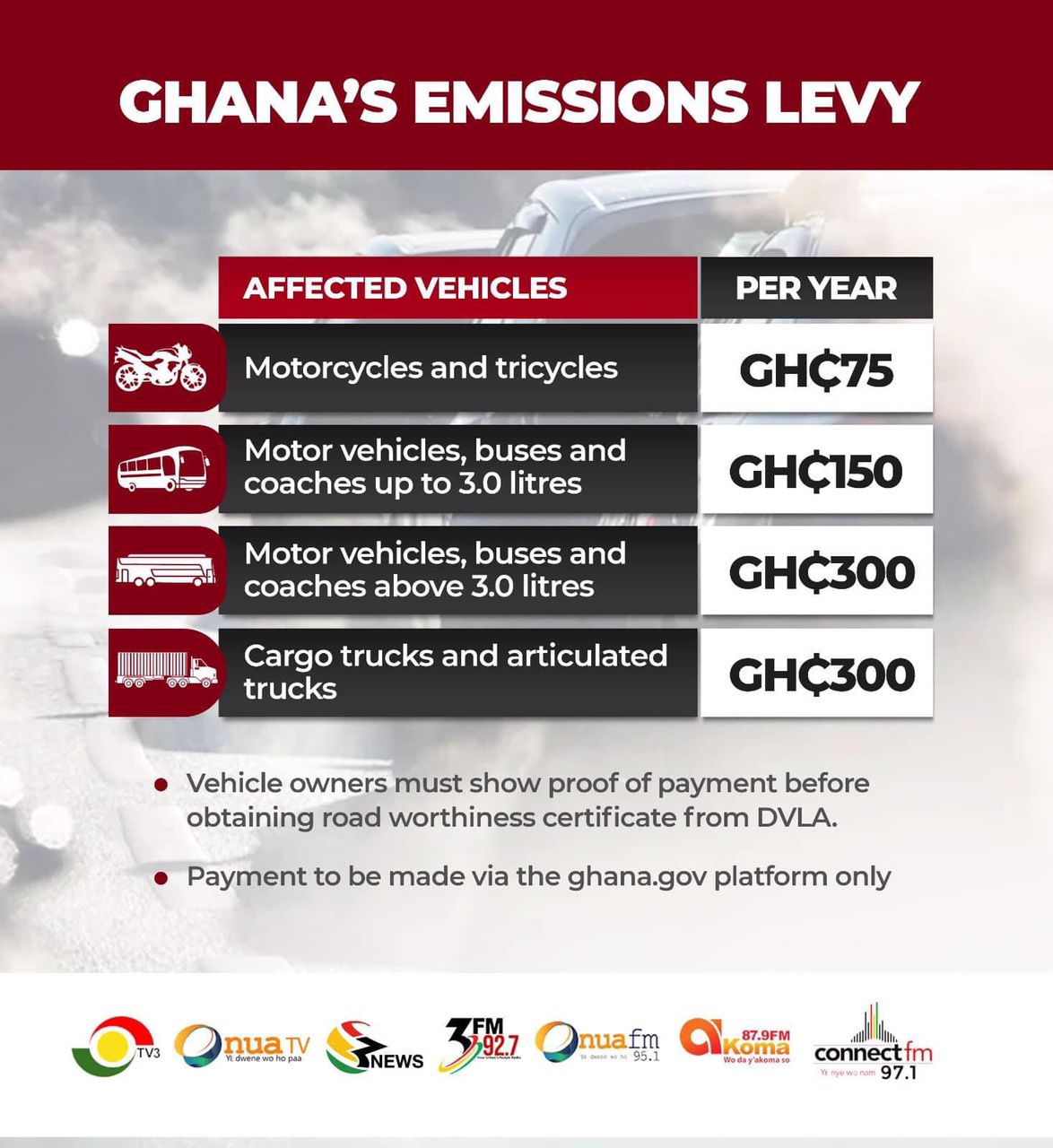

The levy amount varies based on the type of vehicle and its engine capacity.

Motorcycles and tricycles are required to pay GH₵75 per annum, while motor vehicles, buses, and coaches up to 3000 cubic centimeters are required to pay GH₵150 per annum.

Motor vehicles, buses, and coaches above 3000 cubic centimeters, cargo trucks, and articulated trucks are required to pay GH₵300 per annum.

Read the full article below

Ghana’s Introduction of Emission Levy: Environmental Innovation or Economic Burden?

The Institute of Climate and Environmental Governance (ICEG) notes with concern the announcement by Government that the emission levy takes effect today, when there is still lack of clarity as to the management of the likely revenues this will generate to spur climate transition efforts.

ICEG acknowledges that the introduction of the emission levy is expected to have an economic impact on motor vehicle owners by reducing their disposable income and industries reliant on high-emission fossil fuels will experience an increase in their operational costs. Nonetheless ICEG believes that the introduction of this levy is crucial for Ghana’s energy transition agenda in attaining net-zero targets and would align with both environmental objectives and the socio-economic well-being of the citizens and industries in Ghana.

Despite the progressive nature of the Levy, ICEG is concerned about the apparent lack of commitment by Government beyond the imposition of the Levy, to investing the expected revenue on financing green infrastructure. Based on the analysis of the Act, there is no stated portfolio established to use the revenue generated to finance our energy transition efforts. There is therefore the risk that opens up the expected revenue to mismanagement and its associated consequences. Countries like Germany and Italy use almost 95% of its emissions taxes to finance their green projects and initiative but there is the risk in Ghana that, the money will be spent on unrelated issues.

ICEG also disagrees with the taxation approach on motor vehicles, buses, and coaches. Our position is anchored on the school of thought that different motor vehicles emit CO2 at varying levels depending on the year of make of the vehicle and its maintenance regime. This makes it unjust for low polluters to pay the same rate as high polluters.

Recommendation

- Proceeds accrued should not be deposited into the Consolidated Fund. Government should consider setting up an Emission Fund to ensure a proper accountability mechanism that ensures judicious allocation of funds generated.

- Call on the Government to slowly implement the Levy and put up the necessary institutional infrastructure for effective implementation and use of revenue.

- A progressive tax structure approach that promotes equity and fairness should be considered to ensure the perpetual use of cleaner vehicles. Thus, rates associated with emitters who use internal engine combustion motor vehicles up to 3000 cc should be redefined. Regardless of the engine size, owners of motor vehicles manufactured within five years should not be subject to the same rate as those with motor vehicles manufactured over five years.

- Encourage the adoption of eco-friendly vehicles by instituting rebates and incentives regimes for owners of low-emission vehicles.

- Proceeds generated should be channeled toward climate-related initiatives including renewable energy projects, reforestation as well as pollution control measures.

- Government should consider intensifying public awareness to inform citizens of the environmental benefits of reducing emissions.

Signed

Kwesi Yamoah Abaidoo

(Policy Lead, Climate Finance and Energy Transition)

+233 (0)24 934 9948

THANK YOU for constantly reading stories on MyGhanaMedia.com, a news publishing website from Ghana. Kindly like, follow, comment, and SHARE stories on all social media platforms for more entertaining updates!

Follow us on Twitter: https://twitter.com/

Source: MyGhanaMedia.com

There are four types of content published on MyGhanaMedia.com daily: curated content; syndicated content; user-generated content; and original content.

MYGHANAMEDIA.COM Best Source Of Latest News

MYGHANAMEDIA.COM Best Source Of Latest News