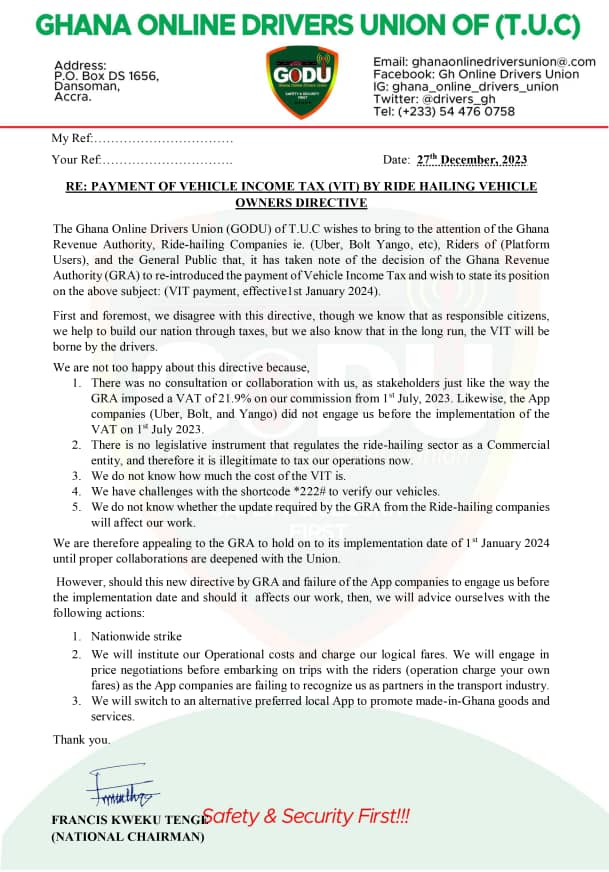

The Ghana Online Drivers Union (GODU) is threatening a nationwide strike should stakeholders fail to engage leadership on the introduction of the Vehicle Income Tax (VIT) for ride-hailing drivers.

This follows an announcement by the Ghana Revenue Authority (GRA) that ride-hailing vehicle owners will start paying the new tax effective January 1, 2024.

In a notice issued by the authority, it said the levy is in accordance with Section 22 of Regulations 2016, LI 2244 which indicates that “any commercial vehicle owner that earns income from the operation of a commercial vehicle shall pay income tax quarterly”.

The authority, therefore, urged ride-hailing companies operating in Ghana – Uber, Yango and Bolt – to update their digital platforms to incorporate the new tax requirements.

But responding to this, the Ghana Online Drivers Union (GODU) says GRA must postpone the implementation of the VIT and initiate discussions with the union to address their concerns.

GODU argued that the ride-hailing sector also lacks proper legislative regulations, making it unclear whether drivers can be classified as commercial vehicle owners.

It has subsequently threatened to pass on the payment of the fees to customers or riders should GRA go ahead to implement the new VIT.

Find the statement from the union below:

THANK YOU for constantly reading stories on MyGhanaMedia.com, a news publishing website from Ghana. Kindly like, follow, comment, and SHARE stories on all social media platforms for more entertaining updates!

Follow us on Twitter: https://twitter.com/

Source: MyGhanaMedia.com

There are four types of content published on MyGhanaMedia.com daily: curated content; syndicated content; user-generated content; and original content.

MYGHANAMEDIA.COM Best Source Of Latest News

MYGHANAMEDIA.COM Best Source Of Latest News