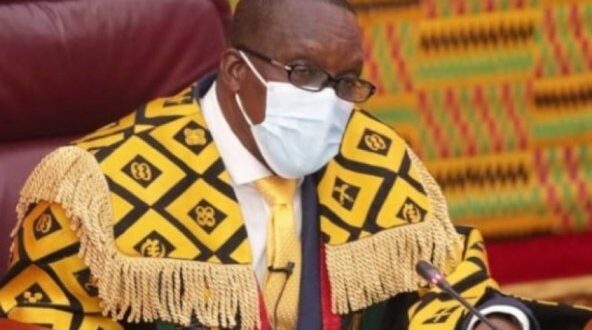

The Speaker of Parliament, Alban Bagbin is proposing the formation of a seven-member committee to probe the issues in a petition brought before the house by two majority shareholders in banks that were affected by the financial sector clean-up.

The Speaker made the proposal after the petitions were officially presented on the floor by MP for Bawku Central, Mahama Ayariga on Tuesday, March 23, 2021.

Two citizens, Prince Kofi Amoabeng and Dr. Kwabena Duffuor petitioned Parliament to investigate the conduct of the Bank of Ghana and the Ghana Stock Exchange for revoking the license of UT Bank as well as uniBank and delisting them from the country’s stock exchange.

The petition also seeks the restoration of the licenses of these banks. After debating the petition, the House agreed to form a seven-member committee.

Meanwhile, the leadership of both the Majority and Minority caucuses have up to March 31, 2021, to present names of MPs to be part of the committee.

Background

Prince Kofi Amoabeng and Dr. Kwabena Duffuor last week petitioned Parliament to investigate the conduct of the Bank of Ghana and the Ghana Stock Exchange following the revocation of the license of their respective financial institutions — UT Bank and uniBank.

Dr. Duffuor, founder of now-defunct uniBank and Mr. Amoabeng, former Chief Executive Officer of collapsed UT bank, had the licenses of their respective financial institutions revoked during the banking sector clean-up which commenced in 2017.

For UT Bank, the apex bank claimed it took the action against the institution because it was insolvent and was unable to recapitalise despite several assurances from the company’s shareholders.

The apex bank also gave similar reasons for the revocation of uniBank’s license saying the financial institution was significantly undercapitalized.

The Bank of Ghana also claimed that shareholders of uniBank used monies from the bank to acquire estate properties in their own names.

According to the central bank “uniBank’s shareholders and related parties admitted to acquiring real estate properties in their own names using the funds from the bank under questionable circumstances.” While uniBank was merged with four other banks to form the Consolidated Bank Ghana Limited, the Bank of Ghana gave GCB permission to takeover UT bank.

Dr. Duffuor is currently litigating the collapse of his bank with the hope of getting the court to declare that, merging his bank with others to form the Consolidated bank is null and void.

Mr. Amoabeng per the petition documents said his bank’s license was revoked “without due regard to the rules of Administrative Justice guaranteed under article 23 of the 1992 Constitution.”

He is thus asking Parliament to give a directive for the restoration of the license.

Below are excerpts of Mr. Amoabeng’s requests to Parliament:

Investigates the conduct of the Bank of Ghana and the Ghana Stock Exchange for the revocation of UT Bank’s license and delisting the bank without due regard to the rules of Administrative Justice guaranteed under article 23 of the 1992 Constitution.

Directs the restoration of the banking license of UT Bank Limited by the Bank of Ghana and the remedying of the harms done to the shareholders’ property rights as a result of the conduct of the Bank of Ghana.

Gives any other directives that Parliament may deem appropriate.

Dr. Duffour is also asking the house to investigate the “take over appointment of an Official Administrator of uniBank Ghana Limited”.

He is also asking the House to remedy the “harm” done to the shareholders.

Below are excerpts of Dr. Duffuor’s demands:

Investigates the conduct of the Bank of Ghana in the takeover, the appointment of an Official Administrator of uniBank Ghana Limited, and the circumstances of the revocation of the banking license of uniBank Ghana Limited;

Directs the restoration of the banking license of uniBank Ghana Limited by the Bank of Ghana and the remedying of the harms done to the shareholders’ property rights as a result of the conduct of the Bank of Ghana.

Gives any other directives that Parliament may deem appropriate.

Source: Citinewsreoom

MYGHANAMEDIA.COM Best Source Of Latest News

MYGHANAMEDIA.COM Best Source Of Latest News