Mr. Alfred Believe Ahiatsi, Operations Director of National Project Advocacy Group, has taken a swipe at Ghanaians especially members of the National Democratic Congress who are calling out the embattled the former Minister for Water and Sanitation ( Mrs. Cecilia Abena Dapaah) , over some missing monies in her residence.

In a statement sighted by MyGhanaMedia.com, He quizzed the reaction of some Ghanaians who expressed shock at the amount of money allegedly kept in the room of the former Minister.

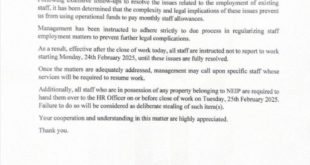

Read the full statement below:

Cash at Home. Has her resignation increased your bank account? Jealousy and envy will kill us.

Several questions and clarifications, considerations must be established in analyzing the matter of Hon. Cecilia Abena Dapaah, the former Minister for Sanitation and Water Resources case. Several are the allegations and chastisement from the general public as to as why She kept such an amount of money in her house as a public officer.

The General Public’s claims that the woman is not a millionaire or can not have that huge sum of money if not stolen. Well I would love to recall the general public that, the Honorable Minister was then worker at Ghana COCOBOD, Ghana Aviation as well as Bank of Ghana to which she had several businesses . She is currently 69years and will be 70years in August, 27th. Her mother was Nana Ode Nyarko II, Otumfour’s Numua Obaapanin. My point is that, she was rich before rising to the level of a Minister, do not draw conclusions upon zero evidence.

Some of you don’t what it takes to enter into Politics like you won’t talk anyhow. You don’t even know How much it takes to win an election.

The bottom line is that, Most Politicians are rich already and barely will you see them talking about their wealth. Do not just assume that they enter into Politics to become rich.

Funny enough, an African will want to take money before voting for a Politician to the neglect of assessing their policies. Well, it is not economically beneficial to put huge sums of money in the house but the evil assumptions on the matter because She is a Public Officer is not healthy.

Let’s allow the appropriate agencies to investigate the matter.

Saving huge sum of money in your house in Ghana, is it a crime or against Bank of Ghana regulations ?

Generally speaking, saving a large sum of money in your house is not illegal in most countries, including Ghana.

However, there are some important considerations to keep in mind:

Safety and Security: Storing a large amount of cash at home can be risky. There is a higher chance of theft, fire, or other unexpected events that could result in the loss of your savings.

Inflation: Keeping money in cash means that it does not earn any interest, and it may lose value over time due to inflation. Banks typically offer interest on savings accounts, which can help preserve and grow your money.

Bank Regulations: In Ghana, the Bank of Ghana may have regulations regarding the amount of cash that can be held by individuals or businesses. It’s essential to check with the Bank of Ghana or consult with a financial advisor to understand the applicable regulations.

Tax Implications: Depending on the source of the money and the total amount saved, there may be tax implications. It’s crucial to comply with Ghana’s tax laws and report any income, including

interest earned on savings. Given these considerations, it is generally advisable to keep large sums of money in secure and regulated financial institutions, such as banks. Banks provide a range of services, including savings accounts, which offer safety, interest, and protection against loss.

If you have concerns or questions about specific regulations in Ghana or any other financial matters, it’s best to seek advice from a qualified financial professional or contact the Bank of Ghana for up-to-date and accurate information. Saving huge amount of money in your house, is it described as scandalous?

Describing the act of saving a huge amount of money in your house as “scandalous” is subjective and depends on the context and cultural norms of the society in which the situation is being discussed. Different people and cultures may have varying views on this matter.

In some cultures, saving a significant amount of money at home may be seen as prudent and responsible, especially if there is a lack of trust in financial institutions or concerns about

economic instability. On the other hand, in other cultures, it might be viewed as unusual or even risky behavior.

In general, there are several reasons why people might choose to keep large sums of money at home:

Distrust of Banks: Some individuals may not trust banks due to past experiences, economic instability, or concerns about bank failures.

Privacy and Anonymity: Keeping money at home might be preferred by individuals who value their privacy and wish to keep their financial matters confidential.

Restricted Access: In some regions, access to banks might be limited, particularly in rural areas, leading people to rely on cash for their financial needs.

However, regardless of cultural perspectives, there are practical concerns with storing significant amounts of cash at home, as mentioned earlier. It is vulnerable to theft, damage, and loss due to various factors like fire or natural disasters. Ultimately, whether it is considered scandalous or not is likely to be based on the specific circumstances and the prevailing attitudes towards such behavior within a particular community or society.

Generally, financial experts advise against hoarding large sums of money at home and recommend using regulated financial institutions, like banks, for secure savings and financial management.

Which article in the Ghanaian constitution lay down how public servants should behave ? As of my last update in September 2021, the Ghanaian Constitution does not have a specific article that lays down how public servants should behave. However, there are provisions in the Constitution and other laws that establish principles of public administration and governance that guide the behavior of public servants.

The key provisions that set the foundation for public service conduct and behavior in Ghana are:

Chapter 23 of the 1992 Constitution of Ghana – “Public Services of Ghana”: This chapter deals with the establishment, organization, and functioning of the public services in Ghana. It outlines the general principles of public administration, including fairness, accountability, and transparency.

Article 35(8) of the 1992 Constitution – “Fundamental Human Rights and Freedoms”: This article states that the state shall take appropriate measures to encourage the active participation of citizens in public affairs, including through public services.

The Civil Service Act, 1993 (Act 327): This Act provides for the establishment and administration of the Civil Service in Ghana. It sets out the code of conduct and ethics that civil servants are expected to abide by.

The Code of Conduct for Public Officers: The Office of the President in Ghana has issued a Code of Conduct for Public Officers, which sets out ethical standards and guidelines for public officers in the performance of their duties.

Other laws and regulations: Various other laws and regulations may also prescribe specific conduct and behavior for public servants, depending on their roles and responsibilities within the government.

It’s important to note that while the Constitution and laws establish general principles and guidelines for public service behavior, the implementation and enforcement of these principles often rely on the actions of relevant government institutions, oversight bodies, and the commitment of public servants to upholding ethical standards in their conduct.

Why is money hoarding not economically beneficial ?

Money hoarding, which refers to the practice of keeping large sums of money in cash or low interest-bearing assets, is not economically beneficial for several reasons:

Lack of Investment and Economic Growth: Hoarding money means that it is not being invested in productive assets or put to use in the economy. Investment is a critical driver of economic growth, as it funds businesses, creates jobs, and stimulates innovation. When money is hoarded,

it sits idle and does not contribute to economic expansion.

Reduced Consumption and Demand: Hoarding money reduces consumer spending because individuals are holding onto their cash rather than using it to purchase goods and services. In a consumer-driven economy, reduced spending can lead to a decrease in demand, which can adversely impact businesses and result in slower economic activity.

Opportunity Cost: Money that is hoarded loses the opportunity for potential gains. If the money were invested in assets like stocks, bonds, or real estate, it could generate returns and grow in value over time. Hoarding money means missing out on potential profits and wealth

accumulation.

Inflation Impact: When money is hoarded and removed from circulation, it can contribute to deflationary pressures in the economy. Deflation, or a sustained decrease in the general price level of goods and services, can lead to a decline in business investment and consumer spending, potentially leading to economic stagnation.

Banking and Financial System Impact: Money hoarding reduces the funds available in the banking system. Banks rely on deposits to lend money to individuals and businesses, promoting economic activity and growth. When money is hoarded outside the banking system, it reduces the amount of money banks have available for lending.

Loss of Value: Holding cash for an extended period can result in a loss of value due to inflation. Inflation erodes the purchasing power of money over time, meaning that the same amount of cash will buy fewer goods and services in the future.

Risk and Security Concerns: Storing large amounts of cash at home or in non-regulated environments poses security risks, as it is vulnerable to theft, fire, or other disasters. In contrast, money deposited in regulated financial institutions benefits from safety measures and

insurance protection.

Overall, money hoarding prevents money from flowing through the economy, inhibits investment, and can lead to economic inefficiencies and reduced growth. Instead, money should ideally be put to productive use, whether through investment, consumption, or other means that stimulate economic activity and contribute to a healthier and more vibrant economy.

THANK YOU for constantly reading stories on MyGhanaMedia.com, news publishing website from Ghana. Kindly like, follow, comment and SHARE stories on all social media platforms for more entertaining updates!

Follow us on Twitter: https://twitter.com/

Source: MyGhanaMedia.com

There are four types of content published on MyGhanaMedia.com daily: curated content; syndicated content; user-generated content; and original content.

MYGHANAMEDIA.COM Best Source Of Latest News

MYGHANAMEDIA.COM Best Source Of Latest News