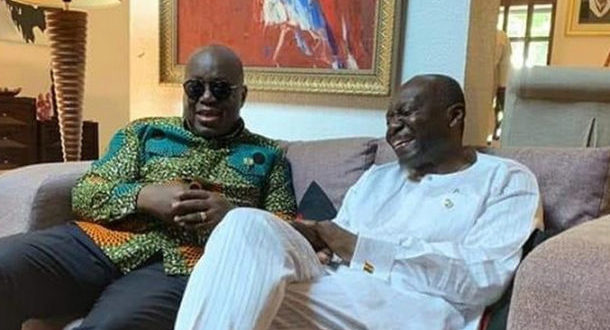

After months of missed deadlines, the Nana Addo Dankwa Akufo-Addo government finally clinched the approval of the board of the International Monetary Fund (IMF) for the $3 billion bailout it started seeking in November 2022.

Ghana’s 17th visit to the IMF for a ‘bailout’ has been attributed to the mismanagement of the economy by the Akufo-Addo government by experts including the University of Ghana don, Prof. Lord Mensah, and the country director of the World Bank, Pierre Frank Laporte.

In fact, many have called for the head of the Minister for Finance, Ken Ofori-Atta, who has been accused of being the cause of the current economic mess because of his reckless borrowing and booted government expenditure.

Even though accountability for the current economic challenges in the country is important, so is taming the current economic challenges in the country, and this IMF programme presents the government with the opportunity to do so.

The $3 billion in itself will not get the country out of the woods, but the conditions and credibility attached to the IMF programme are very key to the running of the government and hence the alleviation of the economic hardships faced by Ghanaians.

Here is why the $3 billion IMF bailout matters:

$3billion injection (Balance of payment support):

The $3 billion loan as part of the bailout programme would provide the government with a much-needed balance of payment support. Ghana’s currency, the Ghana cedi, depreciated by over 50 percent due to continuous demand for foreign currency for imports.

In fact, the country’s international reserve was nearly depleted, and the country was at risk of not having enough foreign currency for its import needs.

This $3 billion, out of which $600 million was disbursed on the day of the approval of the bailout and $350 million would be disbursed every six months for the three-year programme, will temporarily ensure Ghana has enough foreign exchange for its import needs.

Economic stability:

Most of Ghana’s economic variables have been recovering from unprecedented lows for the past few weeks. The inflation rate, which got to 57 percent at some point, is now a little over 40 percent; the Ghana cedis, which was selling at GH¢ 17 to a dollar ($), is now selling at GH¢ 12, and the prices of fuel products have also reduced drastically.

These gains will be consolidated by the IMF programme. The bailout comes with conditions that will check the activities of the government and ensure that the country’s macroeconomic variables are stable.

Although the details of the bailout have not been made public, many experts have indicated that the programme comes with restrictions, including a cap on employment plus other government expenditures, as well as other austerity measures that ensure that inflation, depreciation and other economic variables continue to stabilise.

Policy credibility:

Another important win for the Akufo-Addo government is that the IMF programme offers policy credibility.

The continuous downgrade of Ghana’s credit ratings by international agencies, like Fitch Ratings, made investors lose trust in the ability of the current government to manage the economy. The IMF programme will boost the confidence of investors in Ghana’s economy, which would lead to them keeping their investments in the country and also encourage new investments.

Bloomberg reported that foreign investors began to look favourably at the country ahead of the approval of Ghana’s IMF programme, which led to an appreciation of the Ghana cedi by over 33 per cent since November 2022.

Debt sustainability:

One of the conditions for the approval of Ghana’s IMF bailout by the board was that the country prove that its debts are sustainable, which it did through the Domestic Debt Exchange Programme (DDEP) and the debt assurance provided by Ghana’s international creditors.

With these debt agreements in place, the payment of loan interest, which is a major component of Ghana’s budget, will be on hold for at least the 3 years of the IMF programme.

This means that the demand for foreign currency for the repayment of Ghana’s international debt will be on hold for a while, which will help stabilise the cedi and make funds available for other important developmental needs.

Access to the international financial market:

One of the key challenges the government faced was the lack of access to the international capital markets after the country’s debts were declared unsustainable, which led to a lot of government projects stalling.

This IMF programme removes this huddle and affords the government the opportunity to go back to the international capital markets to raise funds to boost Ghana’s economic development. According to pronouncements made by its officials, the government was more concerned about having access to the capital market than the $3 billion loan it would be receiving from the IMF.

The Minister of State in Charge of Finance, Dr. Mohammed Amin Adam, stated that the approval of Ghana’s request for a bailout would open doors for Ghana to re-enter the international capital market.

“We will go back to the market because we will leverage on the IMF deal to balance our financing needs. We have development partners supporting, but a chunk of our inflows will come from the market, so with the IMF approval, we are very confident that investor confidence in Ghana will increase.

“The institutions upgrading us will look favourably to Ghana, and then as a result of all these, we could return to market very soon,” he was quoted by citinewsroom.com.

THANK YOU for constantly reading stories on MyGhanaMedia.com, news publishing website from Ghana. Kindly like, follow, comment and SHARE stories on all social media platforms for more entertaining updates!

Follow us on Twitter: https://twitter.com/

Source: GhanaWeb.com

There are four types of content published on MyGhanaMedia.com daily: curated content; syndicated content; user-generated content; and original content.

Admission is still in progress… Get yourself trained in any of our programmes to become a professional healthcare practitioner. Apply now! visit: racoh.edu.gh

MYGHANAMEDIA.COM Best Source Of Latest News

MYGHANAMEDIA.COM Best Source Of Latest News