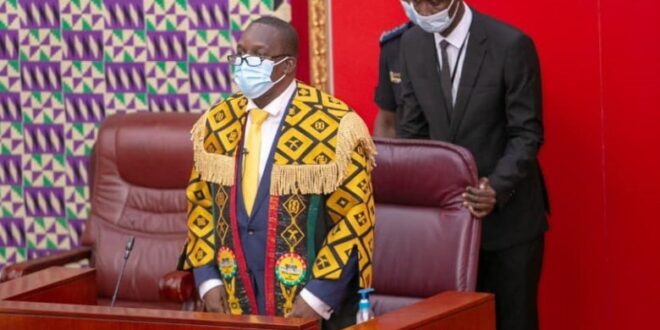

The Speaker of Parliament, Alban Bagbin, has set up a nine-member bi-partisan committee to probe the revocation of licences of UT Bank and uniBank by the Bank of Ghana.

This follows a petition to the House by directors of the affected banks through MP for Bawku Central, Mahama Ayariga, requesting that Parliament probes reasons leading to the revocation of their licences and restoration of same.

Some majority members of Parliament, however, raised objections over the admittance of the petition by the Speaker.

But in a late Tuesday night ruling on the issue, Bagbin said that the petition was in the right direction and has accordingly constituted a committee comprising First Deputy Speaker, Joseph Osei-Owusu as chair of the committee.

Other members include Deputy Majority Leader, Alexander Afenyo Markin, Joe Ghartey, Patrick Boamah, Samuel Atta Akyea, James Avedzi Klutse, Cassiel Ato Forson, Isaac Adongo and Elizabeth Ofosu Adjare.

The petition

The former CEO of defunct UT Bank, Prince Kofi Amoabeng, and owner of collapsed uniBank Ghana Limited, Dr Kwabena Duffuor, petitioned Parliament two weeks ago to investigate the conduct of the Bank of Ghana in the revocation of the banks’ licences.

They also want Parliament to direct the Central Bank to restore their licences.

In a petition cited by Asaaseradio.com, Amoabeng wants Parliament to:

i) Investigate the conduct of the Bank of Ghana and the Ghana Stock Exchange for the revocation of UT Bank’s licence and delisting the bank without due regard to the rules of Administrative Justice guaranteed under Article 23 of the 1992 Constitution.

ii) Direct the restoration of the banking licence of UT Bank Limited by the Bank of Ghana and the remedying of the harms done the shareholders’ property rights as a result of the conduct of the Bank of Ghana.

On his part, Dr Duffuor is seeking the following reliefs from Parliament:

i) Investigate the conduct of the Bank of Ghana in the takeover, appointment of an Official Administrator of uniBank Ghana Limited and the circumstances surrounding the revocation of the banking licence of uniBank Ghana Limited;

ii) Direct the restoration of the banking licence of uniBank Ghana Limited by the Bank of Ghana and the remedying of the harms done the shareholders’ property rights as a result of the conduct of the Bank of Ghana.

Revocation of licences

The Bank of Ghana (BoG) in August 2018 announced that it has revoked the licences of five banks and put them together as Consolidated Bank Ghana Limited.

The banks were uniBank Ghana Limited, The Royal Bank Limited, Beige Bank Limited, Sovereign Bank Limited, and Construction Bank Limited and appointed Nii Amanor Dodoo of KPMG as the Receiver for the five banks.

Prior to the amalgamation of the five banks, the Central Bank had closed down UT Bank and Capital Bank in August 2017.

Reasons for closure

uniBank, according to the BoG, was identified during the Asset Quality Review update in 2016 exercise to be significantly undercapitalised and beyond rehabilitation.

“Shareholders, related and connected parties had taken amounts totaling GH¢3.7 billion which were neither granted through the normal credit delivery process nor reported as part of the bank’s loan portfolio.

“In addition, amounts totaling GH¢1.6 billion had been granted to shareholders, related and connected parties in the form of loans and advances without due process and in breach of relevant provisions of Act 930.

“Altogether, shareholders, related and connected parties of uniBank had taken out an amount of GH¢5.3 billion from the bank, constituting 75 percent of total assets of the bank,” the Central Bank explained back in 2018.

On UT Bank, the Central Bank stated in a press release: “This action has become necessary due to severe impairment of their capital.”

Source: Asaaseradio.com

MYGHANAMEDIA.COM Best Source Of Latest News

MYGHANAMEDIA.COM Best Source Of Latest News